what is considered income for child support in colorado

Child support payments in Colorado are calculated using the income shares method. A larger combined income or.

Filing For Divorce In Colorado Learn How A Court Determines Income For Alimony And Child Support Skulborstad Legal Group

A child marriage is a marriage where one or both spouses.

. Under Colorado Revised Statutes. Calculation of the gross income of each parent gross income being income from any source other than child support payments public assistance a second job or a retirement. Adjusted gross income the child support obligation must be capped at twenty percent of the obligors adjusted gross income.

Both parents regardless of their marital status owe their children financial support to cover basic needs such as food housing clothing and. Therefore the non-custodial parent pays 666 per month in child support or 666 of the total child support. Other customary expenses which the parents expressly include.

Under Colorado law almost all payments to a parent will count as income for purposes of child support including Social Security and Social Security Disability payments. What Is Considered Income. If your employee does not earn enough to meet their support obligation you must withhold a percentage of their disposable income.

The Colorado Child Support Guidelines are designed to make sure that a fair share of each parents income and resources are given to their child. 7031 Koll Center Pkwy Pleasanton CA 94566. Colorado calculates child support using the Income Shares Model of support which is based on the gross income of both parents and general information about what intact families spend on.

Your choice is how many of. Most investment income is passive as opposed to wages salaries commissions and other forms of active income. File a consumer dispute directly with the company who issued your credit report.

The legal definition of gross income for. 1 - Basic Expenses. Colorados Schedule of Basic Child Support Obligations sets this amount.

The minimum guideline amount for obligors earning less than. Contact the county child support caseworker handling your child support case. You have three options.

How Child Support Amount is Determined. The basic child support amount in florida is 74 for a single child if the supporting parent earns less than 50000 per year and the non-supporting parent earns less than 50 of the childs. If the employees past due child support is less than 12.

The non-custodial parents income is 666 of the parents total combined income. It is important to understand exactly what the law considers income when determining a child support award. The custodial parent should use the money to pay for ordinary expenses related to childcare such as food shelter clothing education travel and medical care.

Income can refer to. The starting point for determining the child support payments in Colorado is the pre-tax income of each parent.

High Income Earners The Colorado Child Support Guidelines

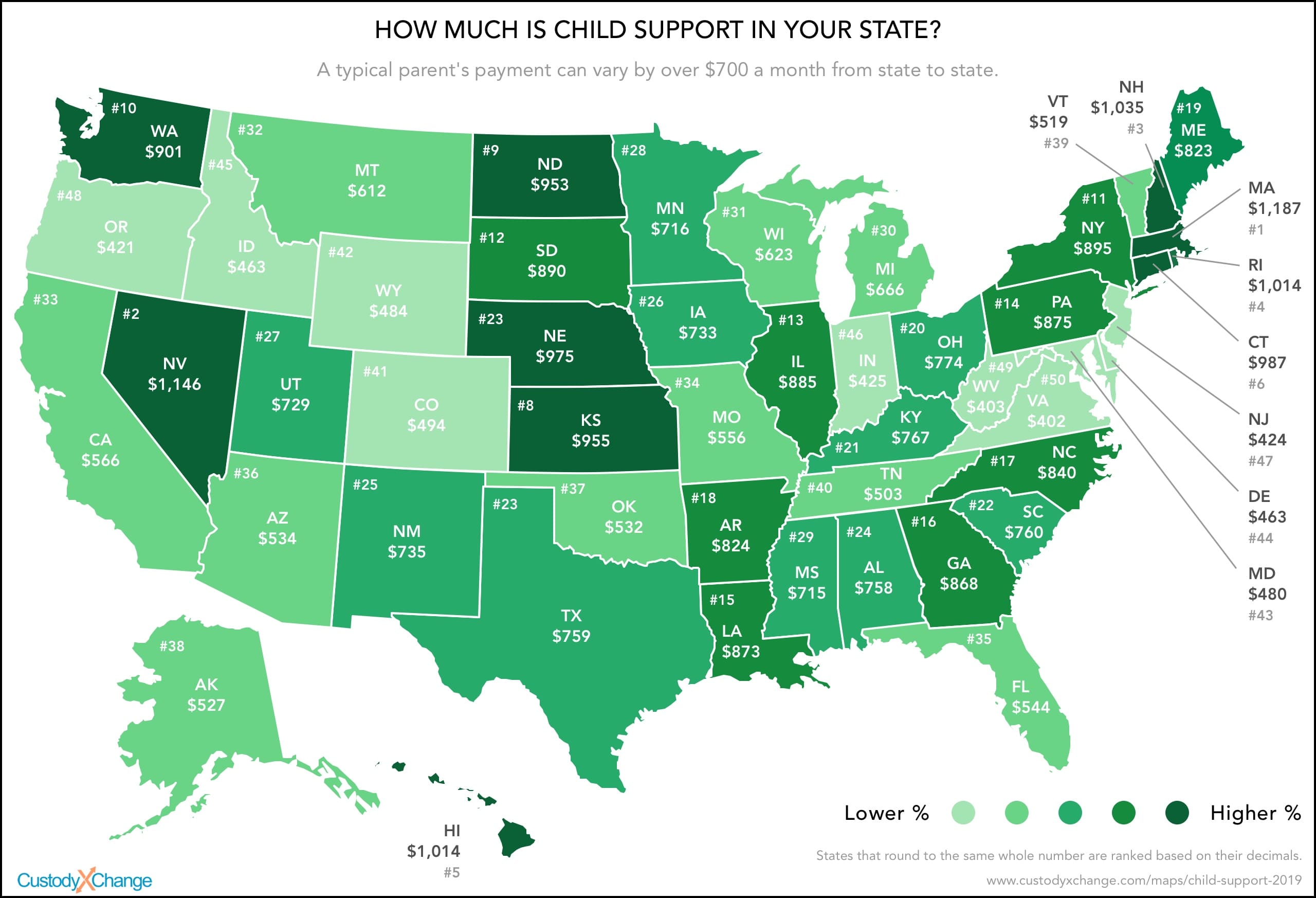

How Much Is Child Support In Your State Custody X Change

Child Support How Judges Decide The Amount Divorcenet

How To Calculate Child Support In Georgia 2018 How Much Payments

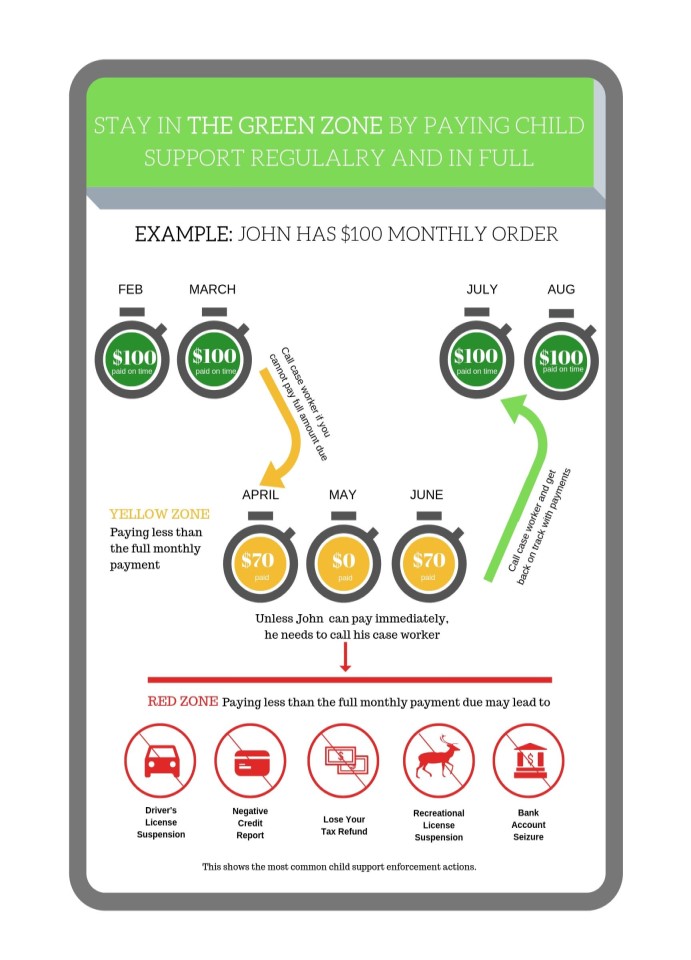

Enforcing Orders Colorado Child Support Services

Colorado Child Support Calculator 2022 Simple Timtab

Child Support Guideline Models

Veterans And Child Support Issues Texas Law Help

Income Withholding For Support Jdf 1804 Colorado

How Child Support Is Determined When A Parent Has No Income

Exploring A Child Support Pass Through Option For Colorado Center For Policy Research

Understanding Colorado Child Support Child Support In Co

Income Withholding Colorado Child Support Services

High Income Earners The Colorado Child Support Guidelines

American Rescue Plan Will Provide Critical Assistance For Kids And Families Colorado Children S Campaign

Colorado Child Support Self Employed Business Income

Child Support Alimony After Retirement Colorado Family Law Guide

How Is Child Support Calculated In Colorado Johnson Law Group